How can your organization implement a fair and effective salary review process? Furthermore, structured salary review process guidelines are essential for GCC employers. Moreover, they ensure equity, compliance, and talent retention. Consequently, this guide provides a comprehensive framework for success.

The GCC labor market is highly competitive and regulated. Additionally, annual salary adjustments require careful planning. Therefore, understanding merit increases and promotion raises is crucial. This ensures your compensation strategy remains both attractive and sustainable.

At Allianze HR Consultancy, we’ve successfully placed 10,000+ professionals across UAE, Saudi Arabia, Qatar, and Kuwait. Furthermore, our 5+ years of GCC expertise supports clients from 50+ countries. Moreover, our Ministry of External Affairs (India) RA license ensures compliance. Therefore, contact our recruitment specialists for expert guidance.

Understanding GCC Compensation Management Requirements

Compensation management in the Gulf region has unique aspects. First, nationalization policies (Nitaqat, Emiratisation) influence budget allocation. Second, cost-of-living variations between cities affect salary bands. Third, expatriate and local employee packages often differ. Therefore, a one-size-fits-all approach fails.

Moreover, GCC employers must balance market competitiveness with internal equity. Additionally, transparency in pay decisions builds trust. For example, clear communication prevents dissatisfaction. Consequently, structured salary review process guidelines provide necessary clarity. They align business goals with employee expectations effectively.

- Market Benchmarking: Regularly survey GCC-specific salary data for roles.

- Budget Allocation: Dedicate a fixed percentage of payroll for annual increments.

- Grade Structures: Implement clear job grades with defined salary ranges.

- Performance Linkage: Tie salary adjustments directly to evaluated performance.

- Compliance Checks: Ensure all adjustments meet local wage protection system rules.

- Documentation: Maintain detailed records for all compensation decisions.

Finally, consider consulting World Bank labor market reports for regional trends. This data supports informed compensation planning.

Salary Review Process Guidelines Strategic Overview

A strategic overview of salary review process guidelines is vital. First, define the program’s objectives clearly. Are you rewarding performance, retaining talent, or correcting pay inequities? Subsequently, establish guiding principles for fairness and consistency. Moreover, secure executive sponsorship and communicate the timeline early.

Furthermore, these guidelines must integrate with your talent management cycle. Therefore, align reviews with performance appraisal periods. Additionally, train managers on their role in the process. For instance, they need skills to justify recommendations. Consequently, this ensures objective and defensible decisions.

- Objective Setting: Align compensation goals with business strategy.

- Cycle Planning: Determine annual or bi-annual review frequency.

- Stakeholder Training: Educate HR and line managers on the framework.

- Communication Plan: Develop clear messaging for employees about the process.

- Technology Enablement: Utilize HRIS systems to manage data and approvals.

- Success Metrics: Define KPIs like retention rates post-review.

Specifically, reference International Labour Organization guidelines on fair wage principles. This strengthens your strategic foundation.

Legal Framework and Compliance Standards

GCC compensation practices operate within a strict legal framework. First, each country has its own labor law. For example, UAE’s Labour Law and Saudi’s Labor Law define basic rights. Additionally, wage protection systems (WPS) mandate timely salary payment. Therefore, all adjustments must comply with these systems.

Moreover, ensure non-discrimination in your pay practices. Furthermore, recent equal pay initiatives in the region emphasize gender equity. Consequently, audit salary data for unintended biases. Also, document the rationale for all differential increases. This protects against legal challenges.

- WPS Compliance: Process all salary changes through official bank channels.

- Contract Amendments: Legally update employment contracts after salary changes.

- Gratuity Calculations: Account for how raises affect end-of-service benefits.

- Minimum Wage Adherence: Comply with country-specific minimum wage rules.

- Data Privacy: Protect employee compensation data as per local regulations.

- Record Keeping: Maintain adjustment records for statutory inspection periods.

Notably, consult UAE government employment regulations for the latest updates. Regular compliance checks are essential.

Salary Review Process Guidelines Best Practices

Implementing salary review process guidelines best practices drives success. First, adopt a data-driven approach. Use market surveys from reputable GCC sources. Additionally, analyze internal pay equity across similar roles. Moreover, create a standardized scorecard for manager submissions. This ensures consistent evaluation criteria.

Furthermore, calibrate recommendations through committee review. This committee should include HR and business leaders. Therefore, it removes individual manager bias. Also, communicate decisions transparently to employees. For instance, provide context on the “why” behind the increase. Consequently, this enhances perceived fairness.

- Market Data Integration: Use at least two current salary surveys for benchmarking.

- Pay Range Penetration: Calculate where each employee sits within their range.

- Calibration Sessions: Hold meetings to compare and adjust team proposals.

- Manager Toolkits: Provide forms, guidelines, and budget worksheets.

- Effective Conversations: Train managers on delivering review outcomes sensitively.

- Feedback Loop: Survey employees post-review to improve the process.

Besides, explore U.S. Department of Commerce trade resources for international compensation insights. This informs your best practices.

Documentation and Processing Steps

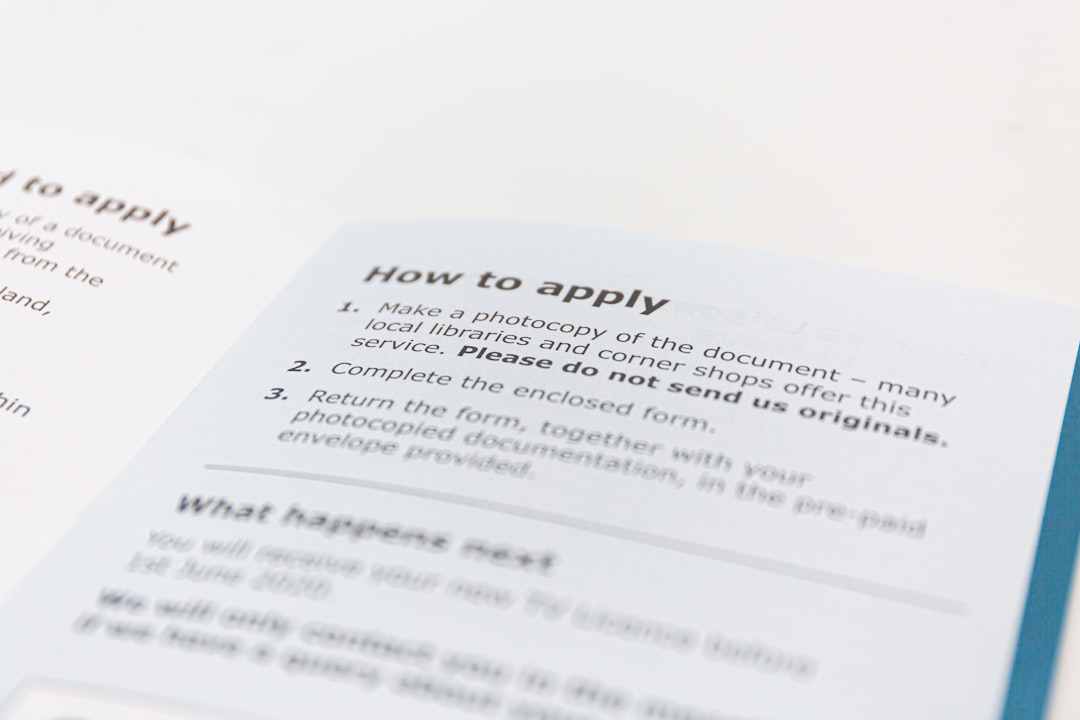

Robust documentation underpins a defensible salary review. First, create a master process checklist. This should outline each step from budget approval to payroll execution. Additionally, standardize forms for manager recommendations. Moreover, require written justifications for all above-guideline increases.

Next, establish a clear approval workflow. For example, define thresholds requiring higher-level sign-off. Furthermore, ensure HR audits all submissions for policy adherence. Subsequently, generate formal adjustment letters for employee acknowledgment. Finally, update all HRIS records accurately. This prevents payroll errors.

- Recommendation Forms: Capture employee performance rating, current pay, and proposed increase.

- Approval Matrices: Define authority levels based on increase percentage or amount.

- Audit Trail: Maintain a complete digital record of all communications and approvals.

- Adjustment Letters: Issue signed letters detailing new salary and effective date.

- Payroll Coordination: Provide finalized spreadsheets to payroll by a strict deadline.

- Filing System: Securely file all documents per data retention policies.

Meanwhile, access our professional recruitment resources for template documents. Proper documentation is non-negotiable.

Salary Review Process Guidelines Implementation Timeline

A realistic implementation timeline for salary review process guidelines is critical. First, start planning 4-5 months before the effective date. This allows for market data collection and budget finalization. Additionally, communicate the upcoming cycle to managers 3 months prior. Moreover, launch manager training sessions 8-10 weeks before submissions are due.

Furthermore, set a firm deadline for manager recommendations. Typically, allow 2-3 weeks for this phase. Subsequently, schedule calibration meetings over a 2-week period. Therefore, HR has adequate time for final reviews and approvals. Finally, communicate decisions 4-6 weeks before the payroll effective date. This manages expectations.

- Month 1-2: Finalize budget, gather market data, update salary ranges.

- Month 3: Launch communications, distribute guidelines, train managers.

- Month 4: Manager submission window, followed by calibration meetings.

- Month 5: HR & executive approvals, generate letters, update systems.

- Month 6: Employee communications, acknowledgment collection, payroll processing.

- Post-Review: Conduct process analysis and gather feedback for next cycle.

Hence, a six-month lead time ensures a smooth annual compensation cycle. For support, schedule consultation appointment with our experts.

Common Challenges and Solutions

GCC employers face specific challenges during salary reviews. First, budget constraints often limit increase pools. Additionally, managers may advocate unfairly for their team members. Moreover, employees have rising expectations based on inflation or market rumors. Therefore, proactive management of these issues is key.

Furthermore, a lack of clear performance metrics complicates decisions. Consequently, establish objective KPIs well before the review cycle. Also, address pay compression where new hires earn close to tenured staff. Alternatively, use one-time bonuses or career development plans as supplements. This maintains morale without disrupting structures.

- Challenge: Limited budget. Solution: Differentiate sharply based on performance, not tenure.

- Challenge: Manager bias. Solution: Implement blind calibration and require strong data evidence.

- Challenge: Pay equity gaps. Solution: Conduct annual pay audits and create remediation plans.

- Challenge: Employee dissatisfaction. Solution: Train managers on communication and context setting.

- Challenge: Administrative burden. Solution: Leverage HR technology for workflow automation.

- Challenge: Market volatility. Solution: Build flexibility for mid-cycle critical retention adjustments.

Indeed, referencing World Health Organization workplace standards can inform holistic wellbeing approaches. This addresses non-financial aspects of retention.

Expert Recommendations for Success

Expert recommendations can elevate your compensation strategy. First, integrate salary planning with broader talent management. Additionally, view compensation as part of the total rewards package. Moreover, include benefits, recognition, and career pathing. Therefore, employees feel valued beyond just the paycheck.

Furthermore, foster a culture of continuous feedback, not just annual reviews. Consequently, salary discussions become less surprising. Also, benchmark your process against industry peers. Participate in HR forums and surveys. Specifically, tailor your approach to GCC cultural nuances. For example, respect for hierarchy may influence communication styles.

- Total Rewards Statements: Provide employees with an annual statement of total compensation value.

- Career Framework Integration: Link salary progression to clear career ladder milestones.

- Manager Accountability: Hold managers accountable for fair and equitable distribution of increases.

- Technology Investment: Implement a modern HRIS with compensation management modules.

- External Audits: Periodically engage a third party to audit pay practices for fairness and compliance.

- Scenario Planning: Model different budget scenarios to prepare for economic shifts.

Finally, continuous learning is vital. Stay updated on GCC labor market shifts and regulatory changes. This proactive stance ensures long-term success.

Frequently Asked Questions About Salary Review Process Guidelines

What is the timeline for salary review process guidelines?

Timeline typically ranges 4-8 weeks depending on country requirements. Furthermore, documentation preparation affects processing speed. Therefore, consult our specialists for accurate estimates.

What documentation is required for compensation review?

Required documents include employment contracts, visa applications, medical certificates, and educational credentials. Additionally, country-specific requirements vary. Moreover, attestation procedures apply.

What are typical costs for annual salary adjustments?

Costs vary by position level, country, and volume. Furthermore, visa fees, medical screening, and documentation affect total investment. Therefore, request detailed quotations from recruitment partners.

How does Allianze HR ensure compliance?

We maintain Ministry-approved RA license status. Additionally, our team monitors GCC labor law changes. Moreover, we conduct thorough documentation verification at every stage.

Which GCC countries does Allianze serve?

We provide recruitment services across UAE, Saudi Arabia, Qatar, Kuwait, Bahrain, and Oman. Furthermore, our South Asian talent network spans India, Nepal, Bangladesh, and Pakistan.

What industries does Allianze specialize in?

Our expertise covers construction, hospitality, healthcare, facilities management, manufacturing, and technical services. Additionally, we handle both skilled and semi-skilled recruitment.

Partner with Allianze HR for Compensation Success

Implementing robust salary review process guidelines is a strategic imperative. Furthermore, it directly impacts retention, motivation, and employer branding. Moreover, a structured approach ensures fairness and legal compliance. Therefore, investing in a clear framework delivers significant ROI.

In conclusion, mastering annual salary adjustments requires expertise. Additionally, merit increases and promotion-based raises must be managed precisely. Consequently, partnering with an experienced HR consultancy provides a major advantage. We help you navigate GCC complexities with confidence.

Allianze HR Consultancy offers end-to-end support for your compensation strategy. From market benchmarking to manager training, we provide solutions. Let us help you design and execute flawless salary review process guidelines. Contact our HR specialists today to transform your compensation management.